GT Radar Radar Weekly 9/18: Will the Fed's Rate Cut Announcement This Morning Be a Watershed Moment for Crypto?

Table of Contents

- Market Analysis – Will the Fed’s Interest Rate Decision Become a Watershed Moment for the Crypto Market?

- US FOMC Interest Rate Decision

- Potential Investment Opportunities

- Binance Copy Trading Analysis

- Breaking News

Market Analysis – Will the Fed’s Interest Rate Decision Become a Watershed Moment for the Crypto Market?

In the lead-up to the Mid-Autumn Festival this week, the market experienced a small surge, with mainstream and altcoins both showing gains of 5-10%. BTC continues to lead the pack, displaying strong momentum, with its dominance reaching a new high of 58.51% today. This is the highest level since April 2021. In contrast, the ETH/BTC exchange rate, as we had anticipated, experienced a decline, even reaching a new low since April 2021, indicating a significant weakness in the altcoin market. This trend also highlights the increased focus on BTC from institutional investors following the approval of the Bitcoin spot ETF, solidifying its connection to the overall economy and stock market, further squeezing the altcoin market.

In the lead-up to the Mid-Autumn Festival this week, the market experienced a small surge, with mainstream and altcoins both showing gains of 5-10%. BTC continues to lead the pack, displaying strong momentum, with its dominance reaching a new high of 58.51% today. This is the highest level since April 2021. In contrast, the ETH/BTC exchange rate, as we had anticipated, experienced a decline, even reaching a new low since April 2021, indicating a significant weakness in the altcoin market. This trend also highlights the increased focus on BTC from institutional investors following the approval of the Bitcoin spot ETF, solidifying its connection to the overall economy and stock market, further squeezing the altcoin market.

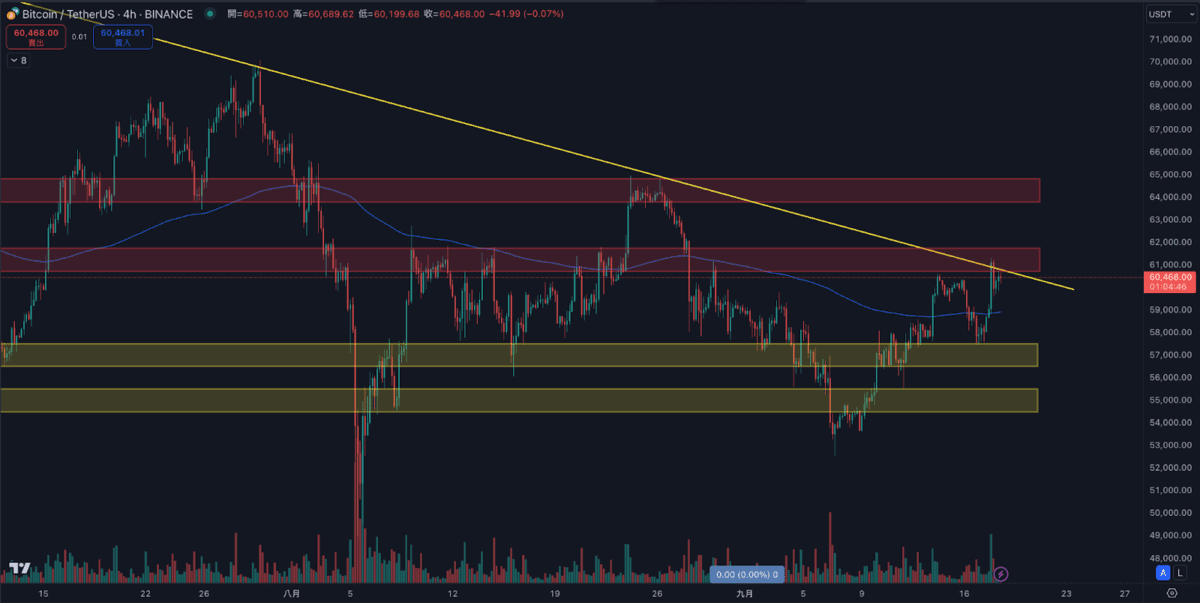

Regarding BTC price trends, it is currently constrained by the downtrend line formed since July, while also facing resistance at the $61,000 level. This presents a good opportunity for short-selling in the short term, given the high potential for profit. However, considering the US FOMC interest rate decision meeting scheduled for 2 am tonight, which will determine whether a 1-basis point or 2-basis point rate cut will be implemented, volatility is anticipated to be extremely high. The entire world is watching closely for this decision, making it advisable to sit on the sidelines, and GT Radar’s portfolio will also be reducing some of its positions. We’ve compiled various perspectives on the interest rate decision for users below.

US FOMC Interest Rate Decision

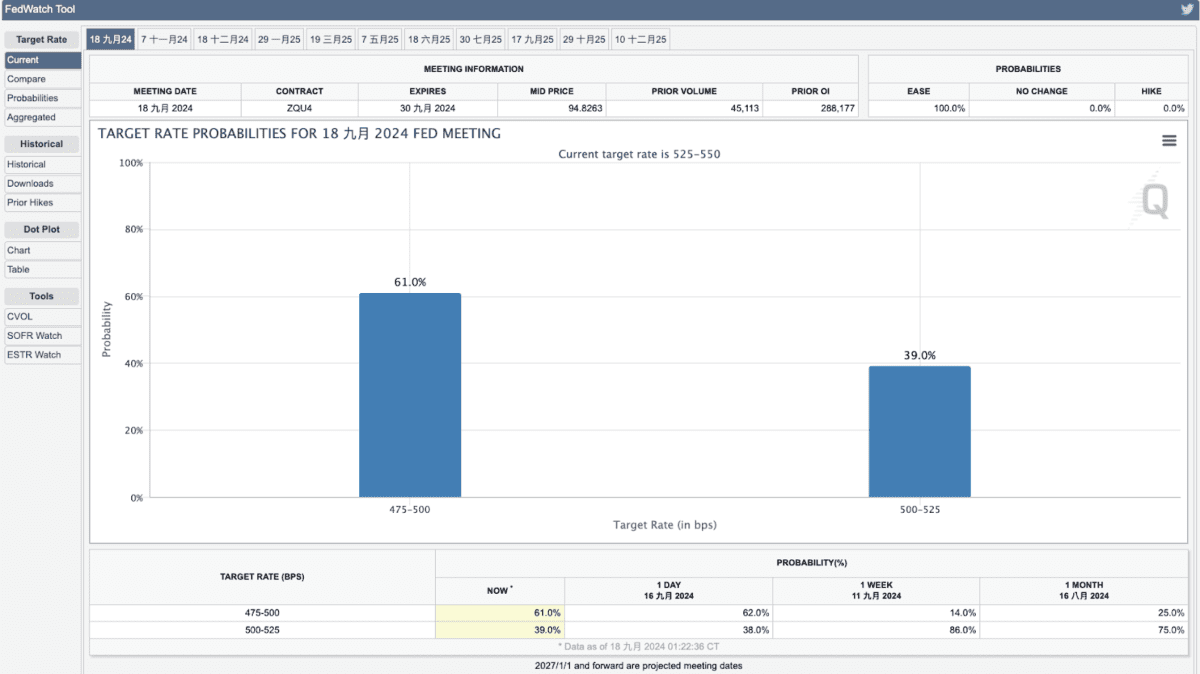

According to FedWatch data, due to reports last week from publications like the Wall Street Journal and the Financial Times citing sources stating that a 2-basis point rate cut is being considered as an option by the Fed, and with decision-makers not explicitly rejecting this option, market expectations have shifted compared to last week. Current data suggests a greater than 60% probability of a 2-basis point cut, in contrast to the approximately 30% probability a week ago.

However, overall, the market still lacks a consensus on the magnitude of the Fed’s rate cut, which will likely result in significant volatility following the announcement. Given the various opinions circulating, it is difficult to predict whether a 2-basis point or 1-basis point cut would be more favorable for Bitcoin and other risk assets in the short term.

However, overall, the market still lacks a consensus on the magnitude of the Fed’s rate cut, which will likely result in significant volatility following the announcement. Given the various opinions circulating, it is difficult to predict whether a 2-basis point or 1-basis point cut would be more favorable for Bitcoin and other risk assets in the short term.

Arguments in Favor of a 1-Basis Point Rate Cut

Analysts at Standard Chartered Bank have warned that the Fed should not cut rates by 2 basis points, as economic data does not provide sufficient justification for such a drastic move at the upcoming meeting. Such a move would carry excessive risk and could even lead to an increase in the unemployment rate in September.

Jean Boivin, head of the BlackRock Investment Institute, echoed this sentiment, suggesting that market expectations regarding the Fed’s rate cut may be overly optimistic, as inflation risks remain.

Expectations for a 2-Basis Point Rate Cut Heat Up

Morgan Stanley believes that the Fed may lean towards a 2-basis point rate cut, as the bond market indicates that monetary policy is lagging. If interest rates remain high for an extended period, it could potentially harm the economy.

Meanwhile, the Head of Rates Strategy at Societe Generale warned that the market is already prepared for a 2-basis point rate cut, and commodity trading advisors (CTAs) have accumulated long positions in the bond market to their highest level in 3 years. If the Fed’s rate cut is less substantial, and Fed Chair Powell hints at a gradual approach to rate cuts, the market could face significant stop-loss pressure.

At the same time, Anthony Scaramucci, founder of hedge fund Sky Bridge, stated in an interview this week that the Fed might cut rates by 50 basis points tonight. He predicts that Bitcoin could reach a new all-time high of $100,000 by the end of the year, driven by a series of upcoming Fed rate cuts and clarity in crypto regulation.

Potential Investment Opportunities

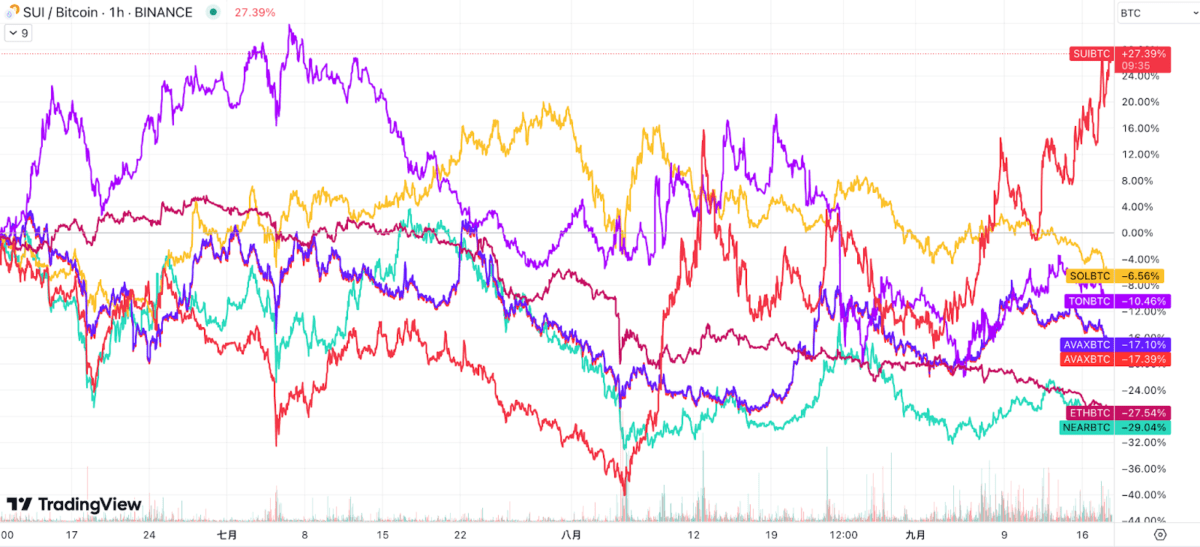

SUI has demonstrated impressive strength during this period of sideways trading. In addition to breaking the downtrend line formed since May 20th, it has also formed a head and shoulders bottom pattern, with trading volume indicating strong buying power following a bottom.

More importantly, SUI is one of the few smart contract public chain tokens that has outperformed Bitcoin in the past three months.

More importantly, SUI is one of the few smart contract public chain tokens that has outperformed Bitcoin in the past three months.

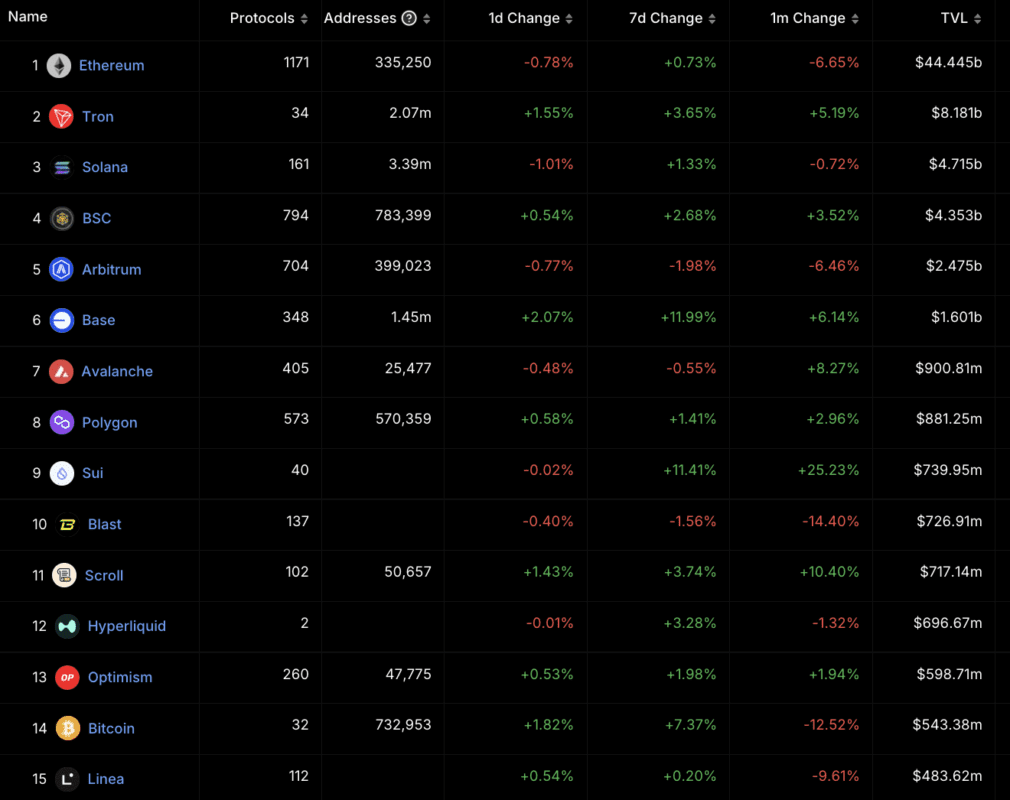

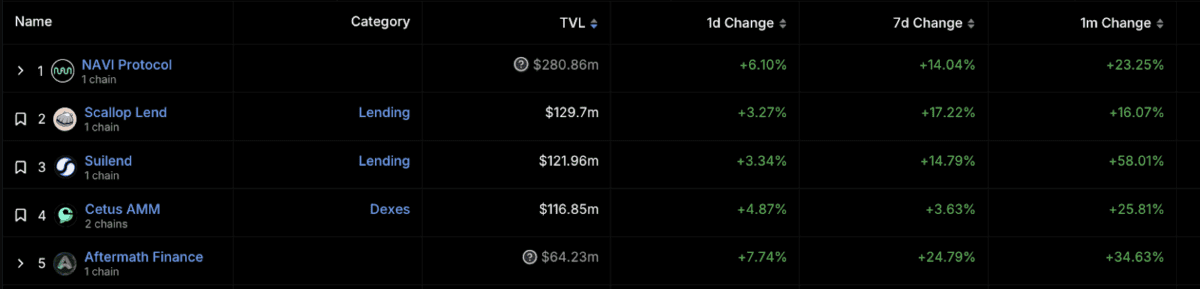

Furthermore, the SUI ecosystem has seen numerous positive developments in recent months. Examples include SuiPlay0x1, a physical gaming machine; offline trading technology; and integration and partnerships with stablecoin issuer Circle. Additionally, data from DeFiLlama shows that the total value locked (TVL) in the SUI ecosystem has also performed exceptionally well compared to its competitors in the past month.

Furthermore, the SUI ecosystem has seen numerous positive developments in recent months. Examples include SuiPlay0x1, a physical gaming machine; offline trading technology; and integration and partnerships with stablecoin issuer Circle. Additionally, data from DeFiLlama shows that the total value locked (TVL) in the SUI ecosystem has also performed exceptionally well compared to its competitors in the past month.

Beyond the SUI token itself, projects within this ecosystem and meme coins (like BLUB) are also worth considering.

Beyond the SUI token itself, projects within this ecosystem and meme coins (like BLUB) are also worth considering.

Binance Copy Trading Analysis

GTRadar – BULL

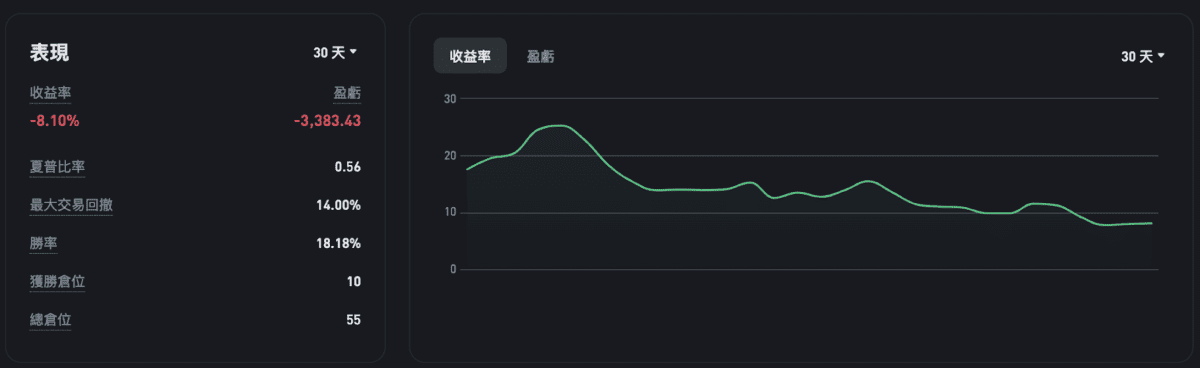

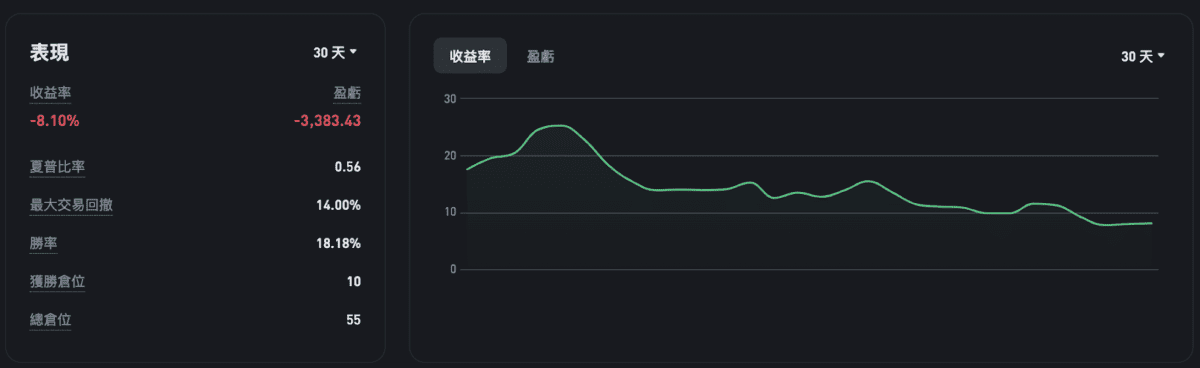

GTRadar – Balanced

GTRadar – Potential Public Chain OKX

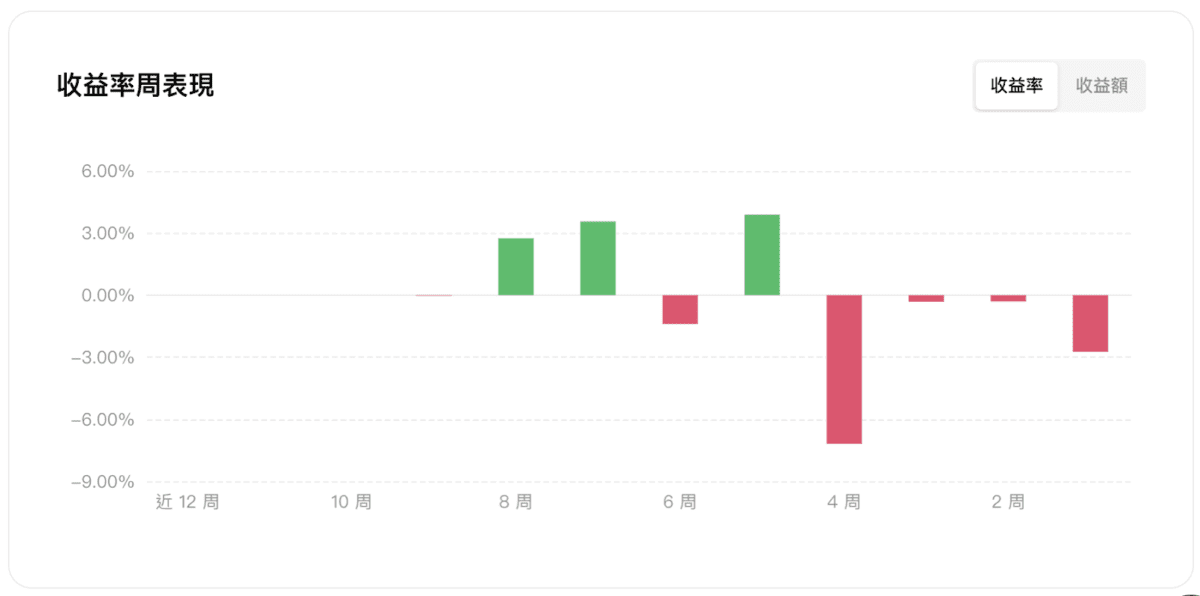

- ‘GTRadar – BULL’, ‘GTRadar – Balanced’, and ‘GTRadar – Potential Public Chain OKX’ have achieved returns of -5.63%, -1.62%, and -2.74%, respectively, over the past 7 days. Their returns for the past 30 days are -7.93%, -8.1%, and -10.56%, respectively.

- Currently, ‘GTRadar – BULL’ holds a net long position of 30%, with BTC as the main asset.

- Currently, ‘GTRadar – Balanced’ holds a net long position of approximately 20%, primarily focused on XRP and BTC.

- Currently, ‘GTRadar – Potential Public Chain’ maintains a net short position of around 5%, with ETH as the main asset.

- Copy traders who frequently switch portfolios often see lower long-term returns compared to those who consistently stick with a single portfolio. Don’t abandon copy trading simply because of short-term drawdowns. From a chart perspective, drawdowns can actually be a good time to start copy trading. Constantly entering and exiting can significantly reduce return rates.

Breaking News

OpenAI, the AI startup with over 1 million paying users, is in talks with investors to raise $6.5 billion in funding, boosting its valuation to $150 billion. Meanwhile, according to The Information, OpenAI plans to release its new reasoning-focused AI model, "Strawberry," within the next two weeks.

Cybersecurity Firm Cyvers: Bitcoin ETFs Could Become Prime Targets for North Korean Hackers

A senior official at blockchain security firm Cyvers claims that North Korean hackers, including the Lazarus Group, may shift their focus to larger targets, including Bitcoin exchange-traded funds (ETFs) in the US.

Pendle Expands Bitcoin Product Line

According to an official announcement, Pendle has announced the expansion of its product line into the Bitcoin ecosystem, launching new products based on Corn, the Bitcoin ecosystem yield network, and Lombard, a Bitcoin re-staking protocol.

Data tracked by digital asset research firm CCData reveals a higher buy-sell ratio in the Bitcoin (BTC) market, indicating active bargain-hunting activity on Kraken and Coinbase exchanges. At the same time, the average transaction size on these platforms suggests that this demand comes from large-volume traders.

Coinbase Announces Wrapped Bitcoin cbBTC on Ethereum and Base Chains

US cryptocurrency exchange Coinbase announced the launch of cbBTC (Coinbase Wrapped BTC) on Thursday, a 1:1 backed ERC20 token backed by Coinbase-custodied Bitcoin, representing a wrapped version of Bitcoin. cbBTC initially supports the Ethereum (Ethereum) blockchain and Coinbase’s Base network, with plans to expand to other chains in the future.

Avenir Capital, the family office of Huobi founder Li Lin, will establish Avenir Crypto, a quantitative hedge fund focused on cryptocurrency. The first phase of Avenir Crypto will have a fund size of $500 million, with Binance serving as the primary trading platform for the fund.

Grayscale Announces the Launch of an XRP Trust Fund

Crypto asset management firm Grayscale announced the launch of the "Grayscale XRP Trust" on Thursday. This is a closed-end fund that allows investors to gain exposure to XRP tokens.

MicroStrategy Makes Additional Purchase of 18,300 Bitcoin.

MicroStrategy revealed that it made an additional purchase of 18,300 Bitcoin at a price of $60,408. As of September 12, 2024, the company holds a total of 244,800 Bitcoin acquired for approximately $9.45 billion, with an average cost of $38,585 per Bitcoin.

Binance Urges Users to Beware of New Malware "Clipper"

Binance exchange published a post today warning users about a new type of malware called "Clipper," capable of intercepting data stored in the clipboard.

ETH/BTC Exchange Rate Hits New Low Since April 2021

Ethereum’s price plummeted on September 16th, dropping nearly 5% to below $2,300. The ETH/BTC trading pair fell below 0.04, reaching a new low since April 2021.

On September 15th, former US President Trump allegedly faced a second assassination attempt while golfing at Trump International Golf Club in West Palm Beach, Florida. Reports indicate that during a security sweep, Secret Service agents discovered a suspect with an AK-47 rifle, prompting them to open fire. However, the suspect was not immediately subdued and managed to discard the rifle and flee. He was eventually apprehended on a nearby interstate highway.

DeFi Project Backed by Trump Family Confirms Token Launch Rumors

World Liberty Financial, a DeFi project supported by the Trump family, confirmed the issuance of its governance token, WLFI, during an online voice conversation on X on September 17th. Information regarding token allocation and public sale was shared. Officials emphasized that there would be no pre-sale, no venture capital or early access, with the majority of supply (62.66%) allocated in the upcoming public sale. A portion of the net proceeds from the sale will be deposited into the project's multi-signature wallet treasury reserve.

MicroStrategy Plans to Sell $700 Million Convertible Bonds!

According to an official press release, US publicly traded company MicroStrategy plans to sell up to $700 million in convertible senior notes to raise funds for purchasing more Bitcoin and repurchasing company debt. This marks the third corporate bond issuance by the company in 2024.

Bhutan Accumulates $7.8 Billion in Bitcoin Through Mining, Nearly One-Third of the Country's GDP

According to on-chain analytics tool Arkham, Bhutan, a landlocked country nestled between India and China, has accumulated 13,029 Bitcoin through its mining operation managed by state-owned investment firm Druk Holdings. This stash is worth over $7.8 billion, nearly a third of the country’s GDP, making Bhutan the fifth largest Bitcoin holder globally.

DBS Bank Announces Cryptocurrency Options Trading and Structured Notes Launch in Q4

DBS Bank has announced the launch of financial products linked to Bitcoin (BTC) and Ethereum (ETH) prices. Starting in Q4 2024, institutional clients will be able to invest in these crypto assets through options trading and structured notes. DBS Bank claims to be the first bank in Asia to introduce such financial products.

Dragonfly Capital Seeks to Raise $500 Million for Its Fourth Fund

According to Bloomberg, venture capital firm Dragonfly Capital is seeking to raise $500 million for its fourth fund, with a focus on early-stage projects. Dragonfly has already successfully raised $250 million and aims to complete the fundraising by the first quarter of next year.

The above content does not constitute any financial investment advice. All data is sourced from GT Radar official announcements. Individual users may experience slight discrepancies due to different entry and exit prices. Past performance does not guarantee future results!