CryptoQuant: Bitcoin Exchange Deposit Addresses Reach Multi-Year Low, Indicating Potential Selling Pressure Relief

Bitcoin Exchange Depositing Addresses at Lowest Level in Years, Indicating Potential Relief in Selling Pressure - CryptoQuant

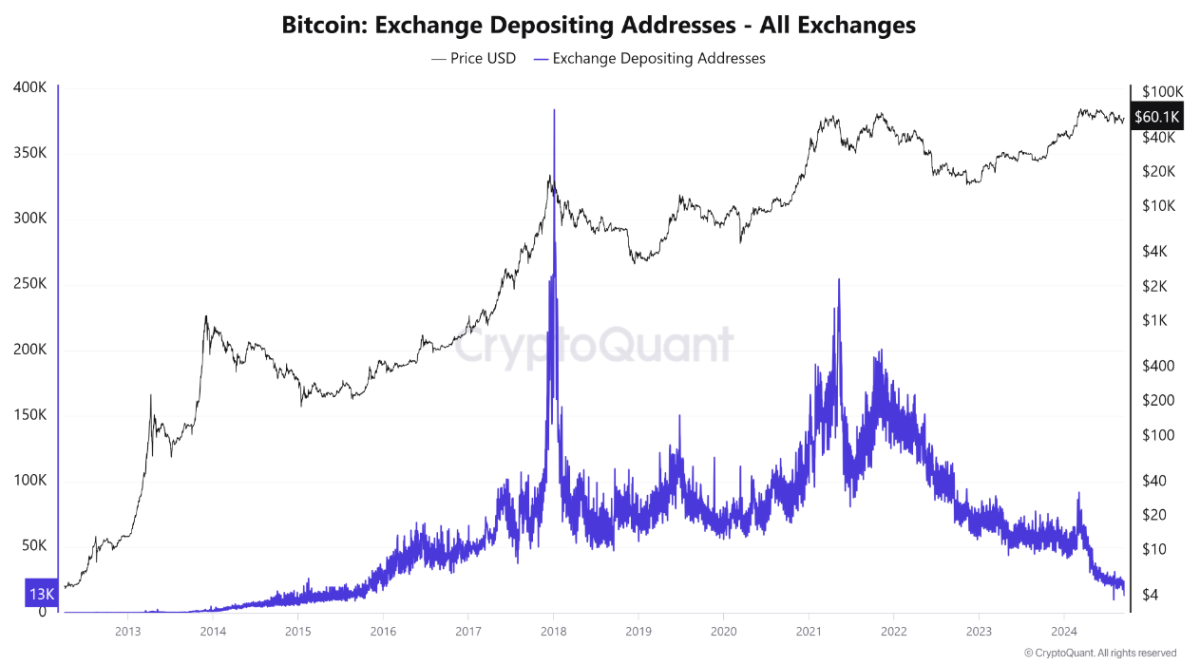

According to blockchain data analytics firm CryptoQuant, the Bitcoin exchange deposit address indicator is at its lowest level since 2016, which may signal a decrease in selling pressure.

The Bitcoin exchange deposit address indicator represents the number of addresses sending inflows to centralized exchanges. CryptoQuant's recent research report shows that the number of deposit addresses has fallen to 132,100, reaching a multi-year low. Their analysis suggests this multi-year low indicates fewer investors are depositing Bitcoin on spot exchanges to sell, potentially indicating a reduction in selling pressure.

Julio Moreno, Head of Research at CryptoQuant, told The Block: "Generally, seeing fewer deposits to exchanges can indicate reduced selling pressure, as there is less Bitcoin available to be sold."

Bitcoin exchange deposit address count, source: CryptoQuant

However, Moreno adds that a lower number of deposits to exchanges might not only signal less interest in selling Bitcoin. It could also mean overall Bitcoin demand is declining, as fewer traders are depositing to bet on rising prices. He explains:

"Some traders deposit to derivatives exchanges to open long positions, betting on a price increase, so fewer deposits could also mean lower demand for Bitcoin in this regard."

Another indicator also highlights the decreasing Bitcoin supply available on centralized exchanges month-over-month. According to CryptoQuant data, the amount of Bitcoin on centralized exchanges has decreased by roughly 470,000 since the start of the year, with a drop of around 15% from January to September. This trend is reducing the circulating supply of Bitcoin and may signal investors are withdrawing their Bitcoin as part of a long-term holding strategy.

Bitcoin reserves on exchanges, source: CryptoQuant