Bitcoin Buy Pressure Higher on Kraken and Coinbase This Month, Demand May Come From Institutional Investors

Bitcoin Bargain Hunters Active on Kraken and Coinbase: CCData

According to CoinDesk, reporting, the buy-to-sell ratio in the Bitcoin (BTC) market indicates active bargain hunting on Kraken and Coinbase exchanges. The average trade size on these platforms suggests this demand comes from large-scale traders.

Data tracked by digital asset research firm CCData shows that the buy-to-sell ratio (comparing the volume of buy and sell orders on Kraken and Coinbase) averaged 250% and 123% respectively this month. A ratio above 100% indicates more buying than selling, signaling net bullish pressure.

CCData research analyst Hosam Mahmoud says the average buy-to-sell ratio shows stronger buying pressure on Kraken and Coinbase, compared to Bybit and Binance, where the ratios were closer to parity, at 99% and 97% respectively. He adds:

"While these observations don't lead to definitive conclusions, they hint that Kraken and Coinbase have become the preferred venues for accumulation lately."

Bitcoin prices experienced a near 10% drop in early September, briefly dipping below the $53,000 level. Since then, Bitcoin has seen an upward trend starting last weekend, recovering the lost ground. At the time of writing, Bitcoin is trading at $58,250.

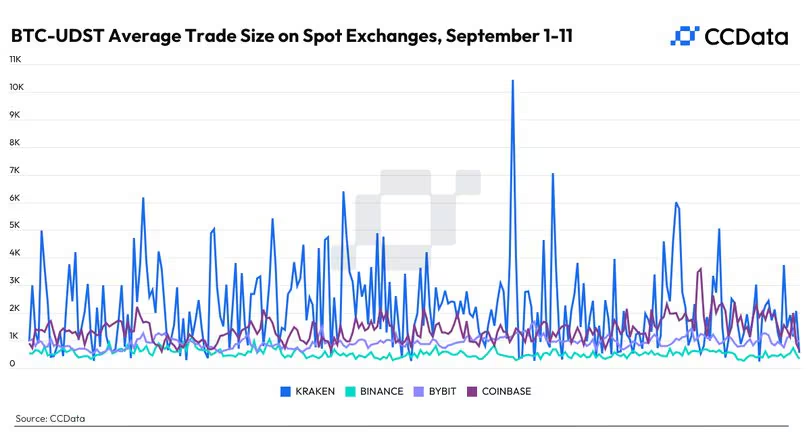

CCData's data also points to Bybit and Binance having more day traders or retail investors, while the bargain hunting on Kraken and Coinbase could be from institutional or larger investors. This is because the average trade size for the BTC/USDT spot trading pair on Bybit this month was $898, and $747 on Binance, significantly lower than the $2,148 and $1,321 averages on Kraken and Coinbase.

Mahmoud says, "This suggests that during this period, Kraken and Coinbase have been attracting larger-sized trades, potentially from institutional or long-term investors, while Bybit and Binance seem to be catering more to smaller, frequent trading needs."

Average trade size for the BTC/USDT trading pair on spot exchanges (Source: CCData)